Small-Molecule Respiratory Drugs Market Forecasted to Hit USD 83,219.8 Million by 2036 as Portfolio Optimization

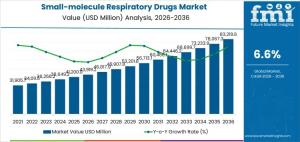

The small-molecule respiratory drugs market is projected to grow from USD 43,919.2 million in 2026 to USD 83,219.8 million by 2036, at a CAGR of 6.6%.

NEWARK, DE, UNITED STATES, January 16, 2026 /EINPresswire.com/ -- The global small-molecule respiratory drugs market is poised for a decade of resilient growth, with its valuation projected to rise from USD 43,919.2 million in 2026 to USD 83,219.8 million by 2036. This steady trajectory represents a CAGR of 6.60%, as pharmaceutical leaders pivot from aggressive product turnover toward a strategy of lifecycle extension and sustained prescriber trust.

According to latest industry data updated as of January 15, 2026, the market’s stability is anchored in the predictable clinical performance and mature manufacturing processes of small-molecule chemistries. While biologic therapies have gained traction in severe cases, small-molecule drugs remain the foundational standard for chronic maintenance and acute relief in asthma and COPD management.

Market Overview: What Is Driving Growth and Why It Matters

The persistent global burden of respiratory diseases—driven by aging populations, urbanization, and environmental factors—continues to cement the role of small-molecule therapeutics.

• Clinical Familiarity & Trust: Small-molecule inhibitors benefit from decades of established clinical safety profiles, ensuring they remain the first choice for the vast majority of physicians worldwide.

• The Affordability Advantage: In an era of tightening healthcare budgets, these drugs offer superior cost-accessibility compared to biologics. This makes them indispensable for cost-sensitive healthcare systems and expanding patient populations in emerging markets.

• API Scalability: Mature manufacturing and robust supply chains allow for rapid geographic expansion with significantly lower operational risk than newer, more complex therapeutic classes.

• Why It Matters: For patients, this growth ensures continued access to affordable, reliable inhalers and oral medications. For payers, it represents a sustainable path to managing high-volume chronic conditions like asthma and COPD.

Commercial Dynamics Favor Reliability Over Price Competition

Growth quality in the coming decade is being shaped by "access economics"—a strategic focus on how drugs are delivered and paid for rather than purely on molecular discovery.

• Lifecycle & Device Alignment: Pharmaceutical companies are protecting their market share through reformulations and fixed-dose combinations. By optimizing how a drug interacts with its inhaler device, manufacturers are improving patient adherence and creating high barriers to entry for competitors.

• Portfolio Optimization: Instead of pursuing high-risk, "moonshot" innovations, top players are focusing on "line extensions"—improving existing products to minimize dosing frequency and reduce systemic side effects.

• Standardization vs. Innovation: Success now favors companies that can balance cost efficiency with portfolio breadth. Prescriber confidence is maintained through a consistent supply of well-characterized drugs that patients can easily use at home.

Request For Sample Report | Customize Report |purchase Full Report - https://www.futuremarketinsights.com/reports/sample/rep-gb-31382

Market Structure: Bronchodilators and Asthma Lead Demand

The industry remains governed by high-volume segments that address the most common clinical needs:

• Bronchodilators (38% Share): These remain the leading product type, serving as foundational therapy for airway obstruction. Their rapid onset of action and compatibility with various delivery systems like MDIs and DPIs drive record utilization.

• Asthma (25% Share): As the largest application segment, asthma’s chronic nature requires long-term pharmacological management. Rising diagnosis rates in pediatric populations and urban centers sustain a predictable demand for daily maintenance therapies.

• COPD & Others: Chronic Obstructive Pulmonary Disease continues to see significant clinical demand, particularly in regions with high smoking rates and aging demographics.

Regional Outlook Through 2036: High-Growth Hubs vs. Mature Markets

While North America and Europe provide a stable base through guideline-based treatment and high insurance coverage, emerging economies are the primary volume drivers:

• India (9.6% CAGR): The fastest-growing market, propelled by massive large-scale patient volumes and a reliance on affordable generics.

• China (9.4% CAGR): Driven by air quality concerns and a rapidly aging population, with a strong emphasis on hospital-based prescribing and local production.

• Brazil (8.8% CAGR): Expanding through robust public healthcare programs that prioritize cost-competitive, small-molecule formularies.

• United States (7.2% CAGR) & Germany (5.9% CAGR): Mature markets where growth is characterized by therapy optimization, payer negotiations, and high generic penetration.

Strategic Competitive Landscape

The market is led by industry giants including AstraZeneca, GSK, Novartis, Boehringer Ingelheim, and Teva. Competitive differentiation is no longer just about the molecule; it is about the "delivery ecosystem." Companies are increasingly partnering with digital health firms to integrate "smart inhalers" that track usage and improve real-world adherence, thereby defending their market share against generic erosion.

Similar Industry Reports

Respiratory Trainer Market

https://www.futuremarketinsights.com/reports/respiratory-trainer-market

Respiratory Distress Syndrome Management Market

https://www.futuremarketinsights.com/reports/respiratory-distress-syndrome-management-market

Respiratory Analysers Market

https://www.futuremarketinsights.com/reports/respiratory-analysers-market

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.