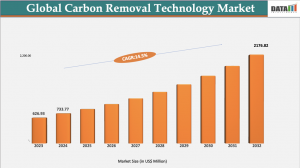

Carbon Removal Technology Market Growth Driven by Decarbonization & Industrial Transition at a CAGR of 14.6% by 2034

Global carbon removal market grows from US$733.77M in 2024 to US$2.18B by 2034 at 14.6% CAGR, driven by decarbonization & clean industrial solutions.

AUSTIN, TX, UNITED STATES, September 29, 2025 /EINPresswire.com/ -- The global carbon removal technology market was valued at US$733.77 million in 2024 and is projected to reach US$2,176.82 million by 2034, growing at a compound annual growth rate CAGR of 14.59% during the forecast period from 2025 to 2034.The market's growth is fueled by rising environmental concerns, supportive regulations on carbon capture, waste-to-energy, and decarbonization initiatives, and industries adopting carbon removal solutions as sustainable alternatives to conventional emissions mitigation methods. For instance, Japan, South Korea, and several EU countries are investing heavily in advanced carbon removal technologies, including Direct Air Capture (DAC), Bioenergy with Carbon Capture and Storage (BECCS), biochar, and enhanced mineralization, to capture and store CO₂ from industrial and atmospheric sources. In 2024, Japan partnered with industry leaders to scale up carbon removal-based circular economy projects, showcasing its early adoption and leadership in the global energy transition.

Download Latest Sample of This Strategic Report (Get Higher Priority for Corporate Email ID) @ https://www.datamintelligence.com/download-sample/global-carbon-removal-technology-market

Impact of Process and Technology Advancements on the Carbon Technology Market

The Carbon Technology Market is undergoing a transformative shift driven by rapid process and technology advancements, which are significantly enhancing efficiency, scalability, and economic viability. Innovations in Direct Air Capture (DAC), Bioenergy with Carbon Capture and Storage (BECCS), biochar production, and enhanced mineralization are enabling more reliable, permanent, and cost-effective CO₂ removal solutions. Recent modular DAC designs, for instance, have reduced installation and operational costs by 15–25%, allowing deployment at both industrial and utility scales.

Advancements in pyrolysis and gasification technologies are improving the conversion of plastic and biomass waste into carbon-negative fuels, creating circular economy synergies and additional revenue streams. Automated monitoring and AI-enabled process optimization are enhancing reaction efficiencies, reducing energy consumption, and minimizing operational downtime. Additionally, breakthroughs in carbon mineralization are accelerating the conversion of captured CO₂ into stable minerals, offering long-term storage solutions that mitigate leakage risks associated with traditional geological storage.

From a market perspective, these technological improvements are reducing the cost per ton of CO₂ removed, expanding adoption beyond early corporate and government buyers to larger industrial sectors. They are also enabling hybrid solutions, combining engineered and nature-based removal approaches to balance permanence, cost, and environmental co-benefits. Furthermore, integration with digital MRV (measurement, reporting, verification) systems ensures transparency, credibility, and investor confidence, facilitating the growth of compliance and voluntary carbon markets.

Competition from Conventional Carbon Mitigation Methods and Emerging Climate Solutions

Despite its advantages, the pyrolysis oil market faces challenges from declining renewable energy costs and the availability of green fuels such as green hydrogen and green ammonia.

One major restraint is the growing competitiveness of renewable electricity and electrolysis-based fuels, which are increasingly cost-effective. According to IRENA, renewable energy prices, especially solar PV and wind, fell by more than 80% between 2010 and 2022. This cost decline makes alternatives like green hydrogen-based fuels more attractive in certain regions.

Upgrading pyrolysis oil to meet international fuel standards requires hydrotreatment and refining, adding cost and complexity. Thus, while pyrolysis oil provides a critical waste-to-fuel pathway, its growth is partially restrained by emerging zero-carbon fuels.

Decarbonization Mandates in Hard-to-Abate Sectors: Cement, Steel, and Chemicals

Hard-to-abate sectors, including cement, steel, and chemicals, are responsible for a significant portion of global industrial CO₂ emissions, collectively accounting for nearly 30–35% of total industrial emissions. Governments and regulatory bodies worldwide are implementing stringent decarbonization mandates to drive emissions reduction in these sectors, recognizing that traditional energy efficiency measures alone are insufficient.

For example, the EU Emissions Trading System (ETS) and regional carbon pricing mechanisms require industrial producers to cut CO₂ intensity, incentivizing investment in carbon capture, utilization, and storage (CCUS) technologies. Similarly, the U.S. 45Q tax credit provides financial incentives for carbon storage, making deployment of DAC, BECCS, and other engineered removal solutions economically viable.

These mandates are compelling industries to adopt low-carbon feedstocks, process electrification, and carbon removal integration. In the cement sector, innovations like carbon curing in concrete and clinker substitution are being deployed to reduce emissions. In steel, hydrogen-based reduction technologies are emerging, while chemical industries are exploring electrochemical production routes and CO₂ recycling.

The combination of regulatory pressure, investor scrutiny, and corporate net-zero commitments is accelerating capital allocation toward carbon removal and decarbonization solutions in these sectors. As a result, the market for carbon technologies in hard-to-abate industries is expected to witness rapid growth over the next decade, creating opportunities for technology providers, project developers, and industrial adopters to scale cost-effective CO₂ mitigation strategies while meeting compliance obligations.

Strategic Partnerships Strengthening Carbon Removal Market Competition

Several major companies in the global carbon removal technology market are competing through large-scale projects and strategic partnerships.

In 2024, the top three players accounted for nearly 35–40% of the global market share.

Climeworks, CarbonCure, and Carbon Clean led with significant shares.

Other key players include Global Thermostat, Blue Planet, Charm Industrial, Carbon Clean Solutions, and CarbonCure, collectively holding the remaining share.

Most companies are expanding deployment through partnerships with industrial corporations, energy firms, and government-backed projects. For instance, in 2024, Climeworks and a European energy consortium announced a collaboration to advance large-scale direct air capture facilities, integrating captured CO₂ into industrial and chemical value chains.

Looking for in-depth insights? Grab the full report: https://www.datamintelligence.com/buy-now-page?report=global-carbon-removal-technology-market

Why Choose This Global Carbon Removal Technology Market Report

● Latest Data & Forecasts – Covers deployment trends, removal technologies (DAC, BECCS, biochar, mineralization), and applications across power, industrial, and agricultural sectors.

● Regulatory Intelligence – Insights into global and regional carbon policies, emissions reduction targets, and climate mandates driving technology adoption.

● Competitive Benchmarking – Evaluates strategies of key players such as Climeworks, CarbonCure, Carbon Clean, Global Thermostat, and Blue Planet.

● Emerging Market Coverage – In-depth analysis of high-growth regions including Asia-Pacific, Europe, and North America, highlighting government incentives, carbon markets, and cross-border project collaborations.

● Actionable Strategies – Explore opportunities in industrial integration, hybrid removal solutions, carbon credit monetization, and scalable DAC and BECCS projects.

● Pricing & Cost Analysis – Detailed assessment of project economics, technology-driven cost reductions, and operational efficiency improvements across carbon removal methods.

● Expert Analysis – Industry-backed insights on carbon removal value chains, technology pathways, and sustainable decarbonization strategies for hard-to-abate sectors.

Get Corporate Access to Live Carbon Removal Technology Industry Intelligence Database: https://www.datamintelligence.com/reports-subscription

Related Reports:

Carbon Farming Market reached US$113.36 million in 2024 and is expected to reach US$330.01 billion by 2032, growing with a CAGR of 14.29% during the forecast period 2025-2032, according to DataM Intelligence report.

The Global Carbon Capture and Sequestration Market is expected to reach at a CAGR of 13.5% during the forecast period (2024-2031).

Sai Kumar

DataM Intelligence 4market Research LLP

+1 877-441-4866

sai.k@datamintelligence.com

Visit us on social media:

LinkedIn

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.